- Total platform rebuild

- New tech stack and frontend

- Next.js, React.js and Storybook

- Multiple API endpoints

- Agile sprint methodology

- Advanced 2FA and authentication

When Currencycloud was acquired by VISA, its legacy financial services platform needed updating to meet strict security and functionality requirements. UIC Digital was on hand to complete the transaction.

The Currency of change

Starting from humble beginnings in 2012, Currencycloud now provides cross-border and multi-currency financial solutions to businesses that stretch from Europe and North America to Asia. Having processed over $75 billion in payments, to more than 180 countries across the world, Currencycloud is a scale-up experiencing rapid growth – and most recently, a multimillion dollar acquisition by VISA.

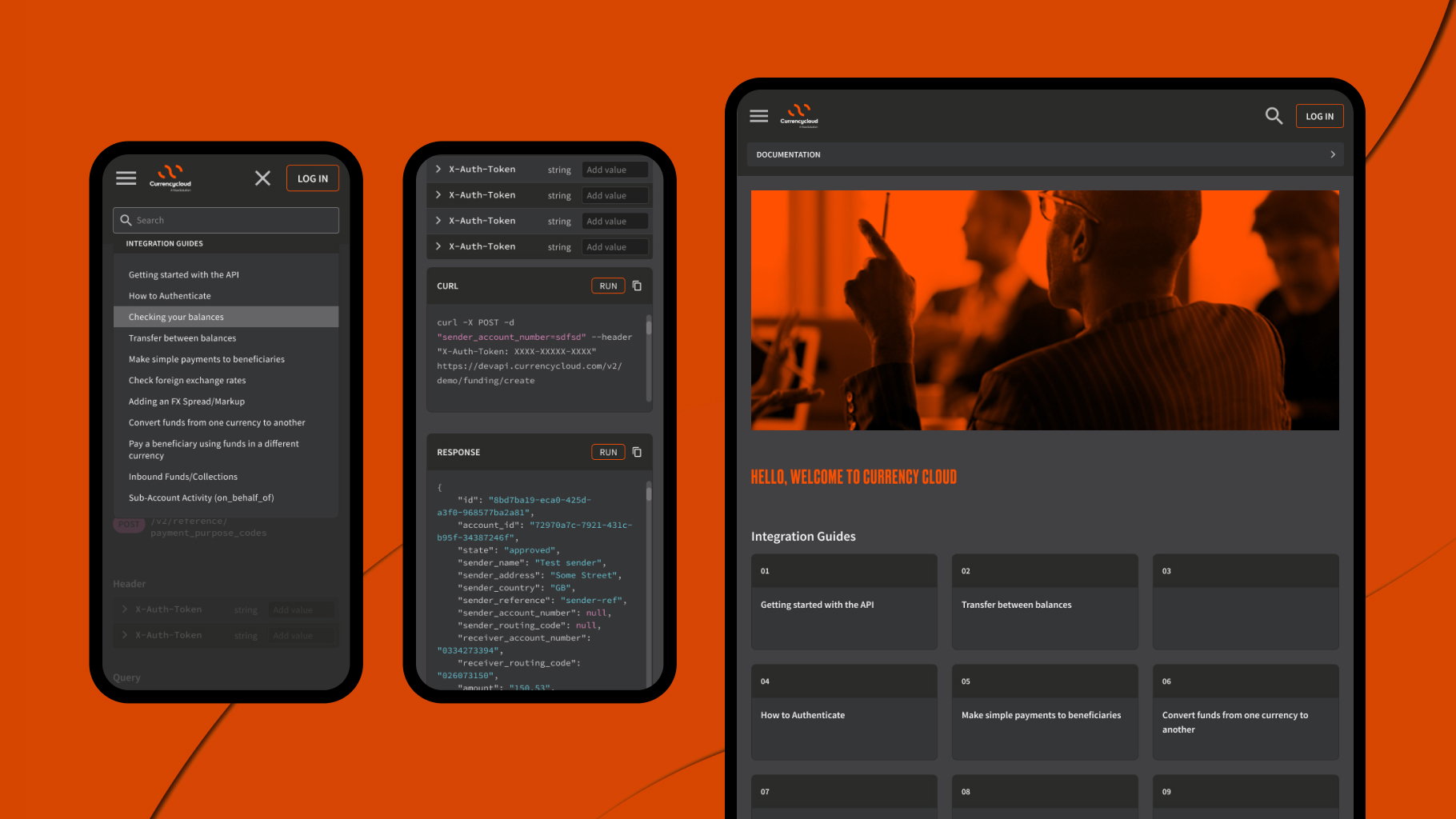

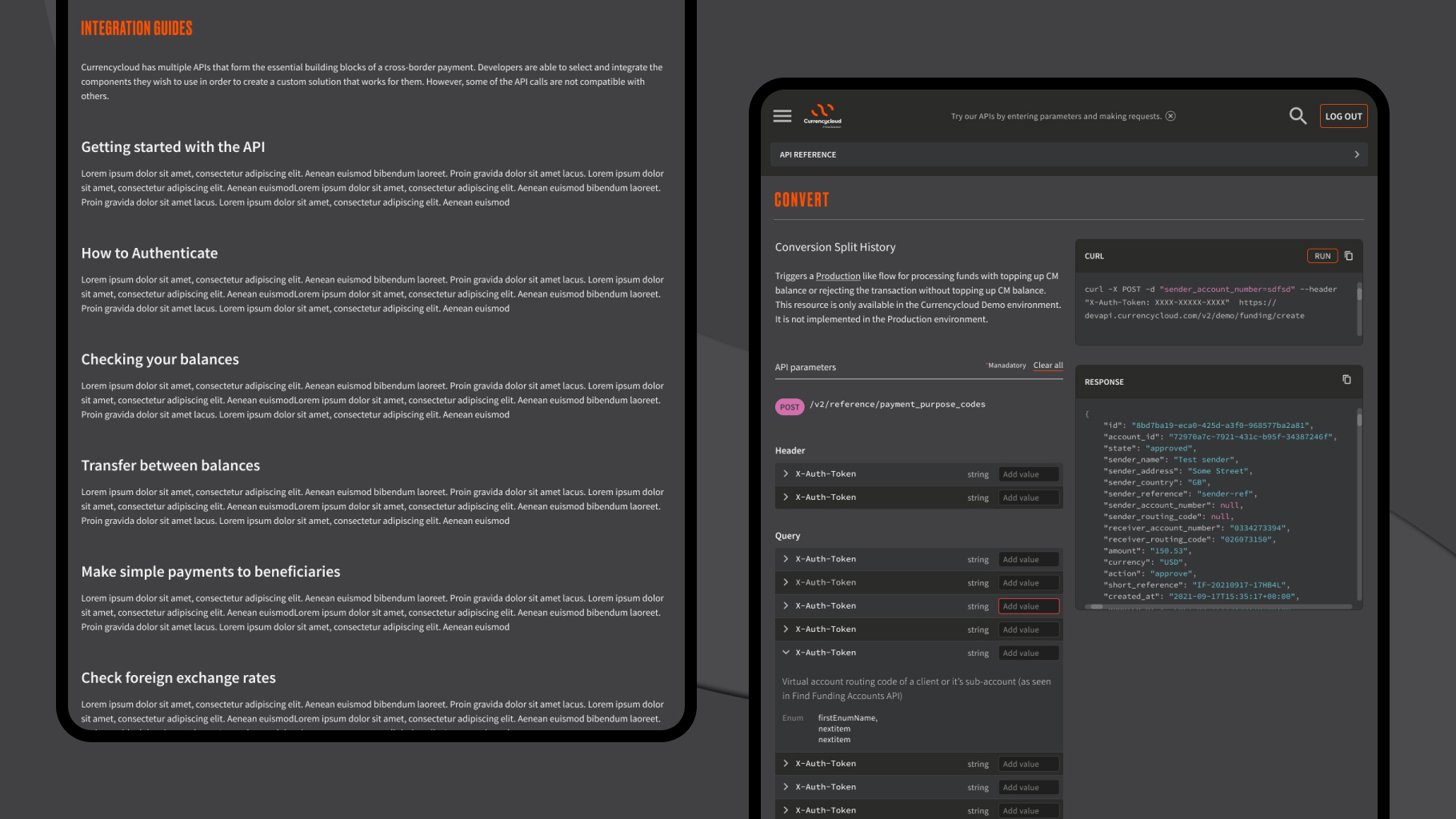

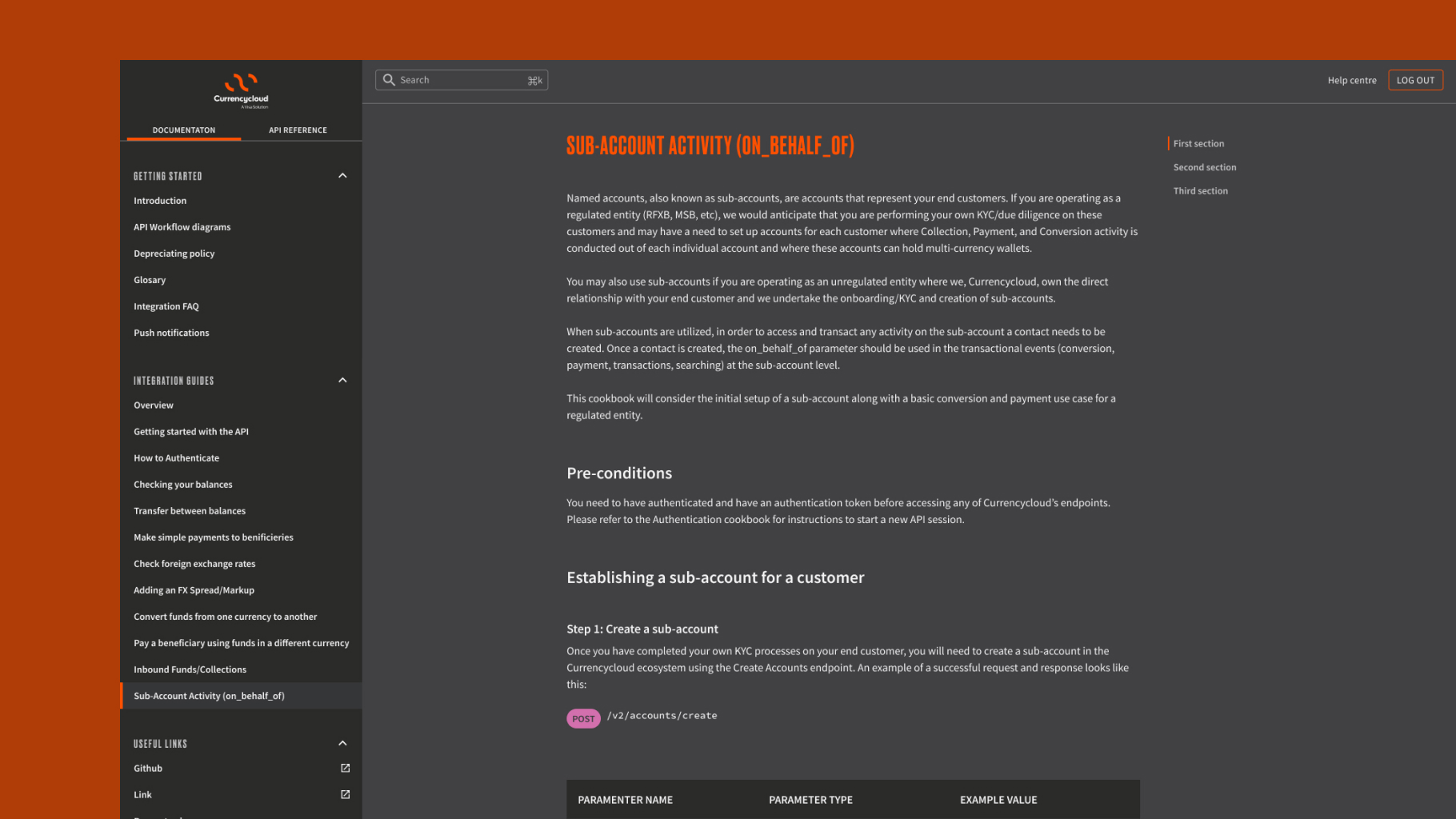

As a result, Currencycloud sought to rebuild its user and white label financial payments platform, using a new tech stack and security enhancements to meet VISA specifications. This also presented an opportunity to scale its user base and revenue and, having successfully redesigned and redeveloped Currencycloud’s developer portal in 2022, UIC Digital was already set to take on the challenge.

Laying the foundations

To rebuild the platform, technical frontend and backend development would be needed, based on the features and functionalities of what was there already.

First, we worked with Currencycloud to lay out what a new technology stack could look like across many different use cases, so we could lock down the best route forward with commerce development in mind. The number of relevant API endpoints remained a mystery, and the legacy product needed investigating to be fully understood. As with all of our projects, we launched into a discovery period first and foremost, to really get under the skin of the existing platform.

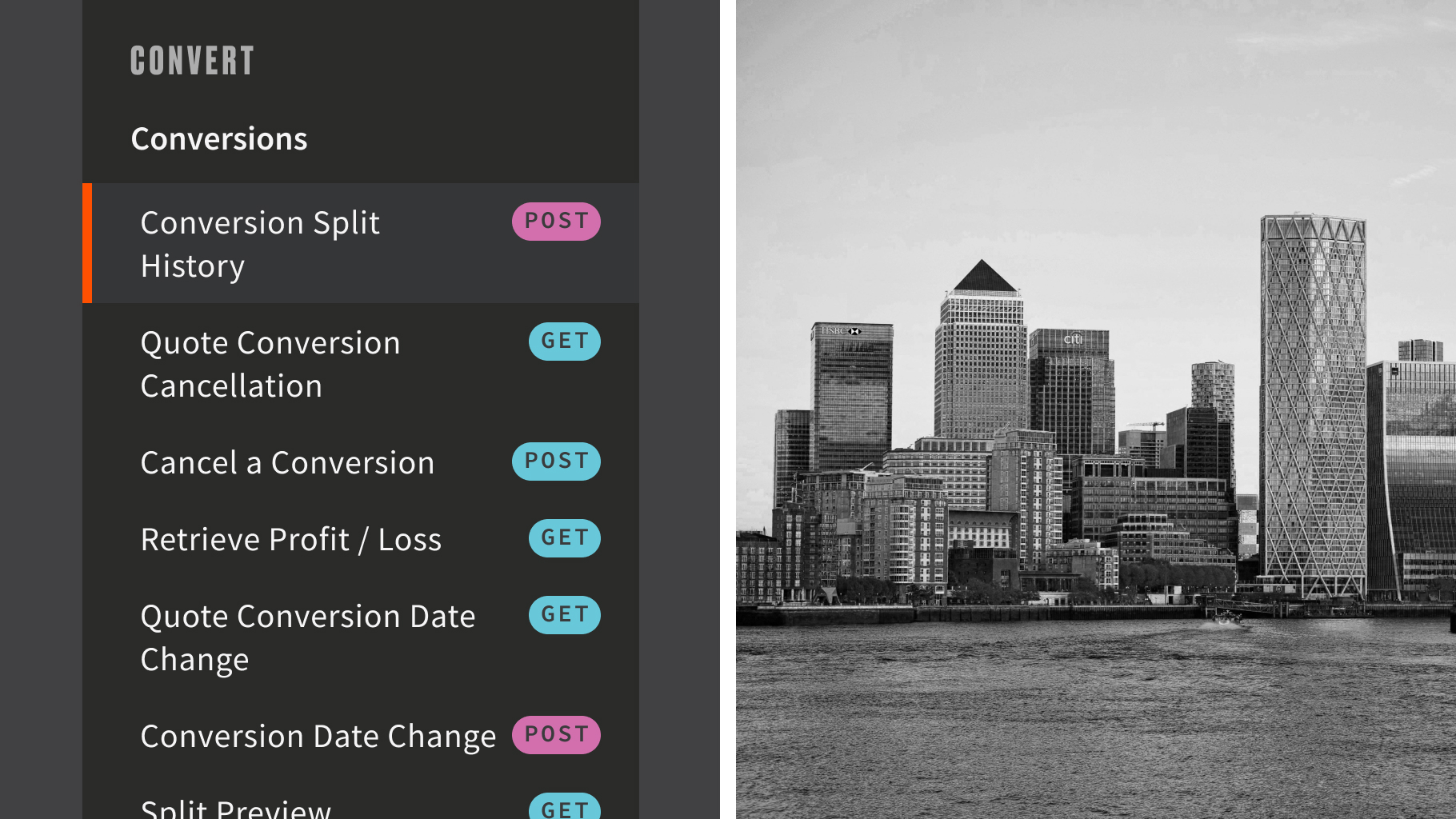

We conducted a mini structural audit, generating a list of templates and features that would become the bones of the project. We ran a review and final validation of the existing platform, creating user stories and a backlog to support them in tow. At the same time, we ran a short backend discovery period too to make sure we fully understood the complexities of the API endpoints and exactly how the backend would need to serve the features on the frontend.

With our backlog created, its user stories were then sized and planned in priority order before work would begin on the build. We’d be working on a sprint-by-sprint basis to make sure we could iterate as we built, matching requirements with the final goal at every step.

It all adds up

We began the technical build in earnest using a two-week agile sprint cadence to start laying down the platform’s initial features and functionalities. We found that Currencycloud’s current frontend application had been built using various technologies and these all needed consolidating into one. We did this using a server side, rendered Next.js application with Typescript.

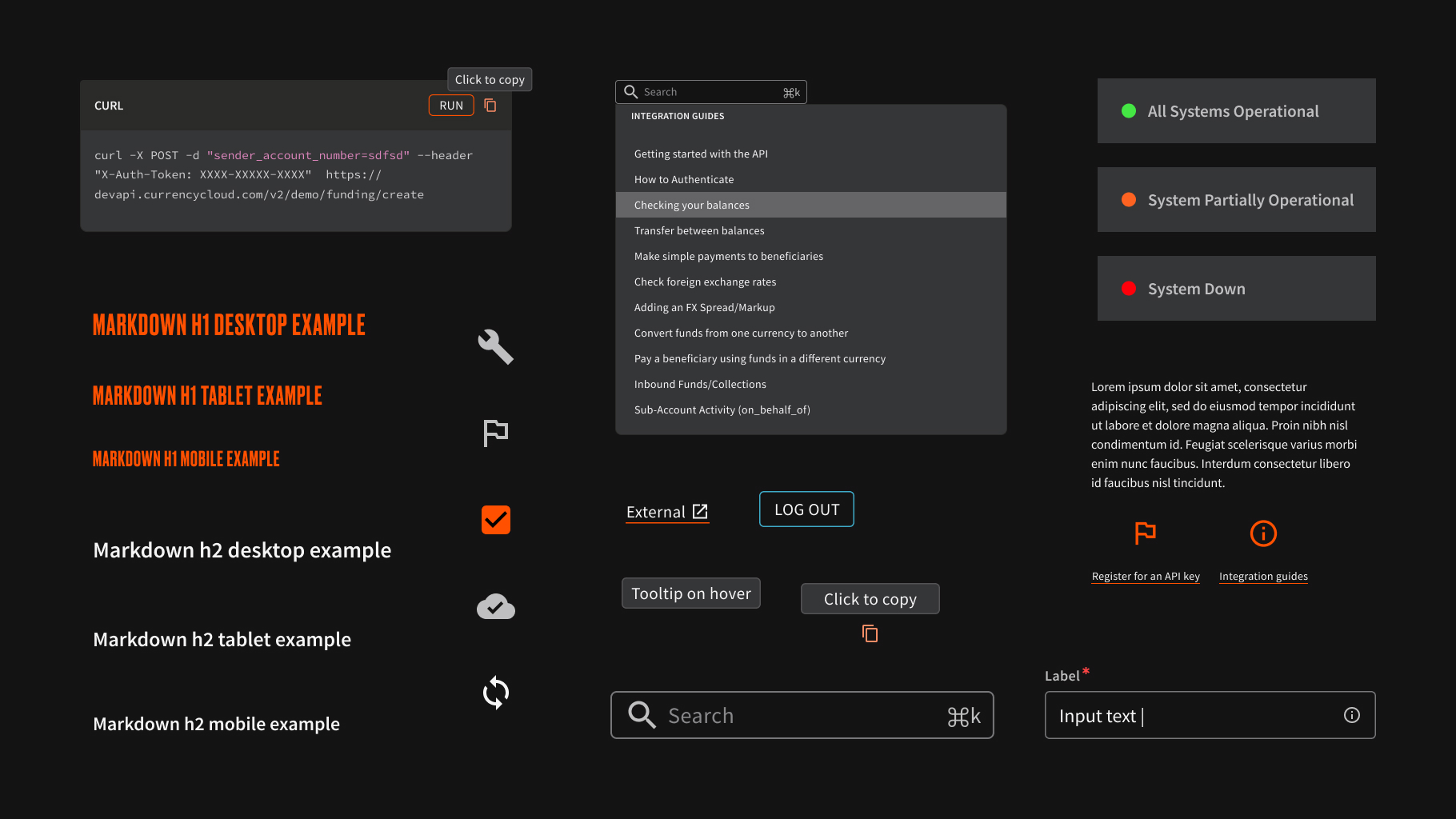

Its tech stack also included UI Components listed and showcased in Storybook, a React Router to power app navigation and routing, React Query with Axios that talked to the Rest API and React context for storing its global state. This paired up with styled components from the existing platform and a Jest unit testing framework.

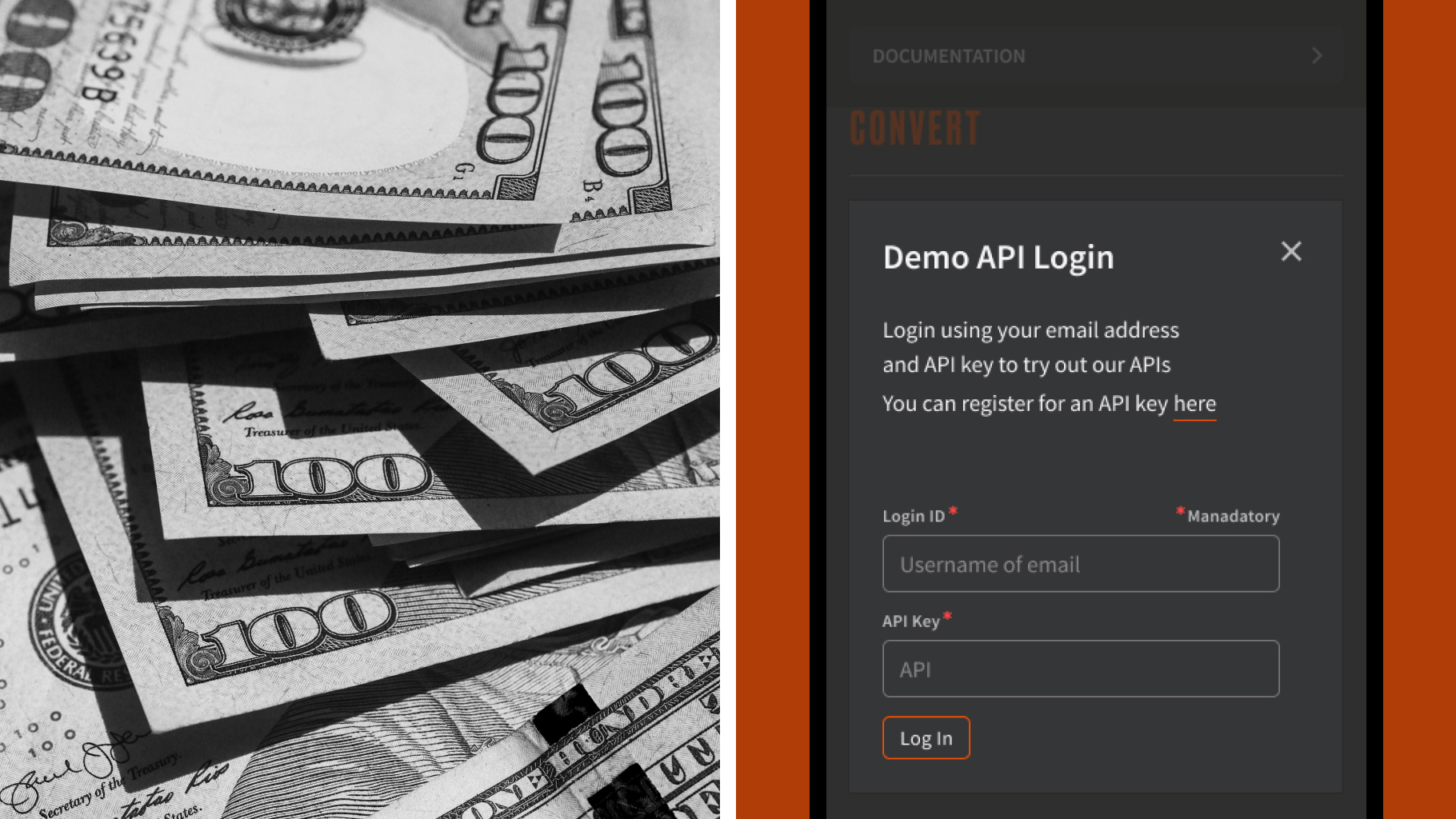

We also built a middleware backend application to connect mandatory data sources and third-party APIs, and format, optimise and send data to the new frontend using a backend-for-frontend (BFF) Rest API. It also brought the Currencycloud API services that generated its business logic together with the frontend. Two-factor authentication and security provided by Currencycloud Authentication Services was also integrated.

During the build process, we built the tools and team onboarding set-up Currencycloud would need for new joiners, finalised its architecture, set-up Storyboard, trained Currencycloud’s development team and got regular sign-off with its stakeholders at every step. We developed and released the platform’s themes, from white label to consumer, and baked in the essential frontend features identified in our discovery period. That included its APIs, 2FA and the backend integrations and REST API endpoints needed to run smoothly. Finally, we produced test cases to make sure everything worked seamlessly.

Show me the money

Time was tight to develop an entire multi-currency financial services platform, built on largely unknown legacy technology – but, by working methodically, we know that progress is sometimes achieved little-by-little. In the end, it all adds up.

As a result, the redevelopment passed its VISA review with change to spare, using a tech stack future-proofed for modifications and interactions. A new design was then planned to launch in phase two of the work.

“I want to offer a sincere thank you to UIC Digital for all of the hard work they’ve put in. The last nine months has been a challenge, but UIC Digital integrated into our team, was flexible in providing support where needed on the frontend and backend, and did a great job of helping us push forward. Unfortunately, it’s not the end of the project for us, but I estimate us to be about 80% of the way there – UIC Digital has been instrumental to that. A great big thank you to all involved.”

Emma Roberts, Senior Project Manager, Currency Cloud.